Time for transatlantic trade to take off

European Union and United States Flags blowing in the wind (Lisa-S/Shutterstock)

*This article is an update of a previous blog post that you can read here.

Trade tariffs continue to pose a threat to a transatlantic economy weakened by COVID-19, but there may now be some light at the end of the tunnel. This month, the Office of the US Trade Representative (USTR) is reviewing its tariff regime against the European Union (EU) in the long running Airbus–Boeing civil aircraft dispute. With French President Macron reportedly urging President Biden toward a negotiated settlement of the dispute and a recent statement by USTR to the same effect, this is the political moment to resolve the conflict. Separate WTO rulings in 2019 and 2020 authorized the US and the EU to impose tariffs on $7.5 billion of European goods and $4 billion of American products respectively. Now, keen to rebuild transatlantic ties, Washington and Brussels must walk the talk to reach an agreement on aircraft subsidies and move the US-EU trade agenda forward.

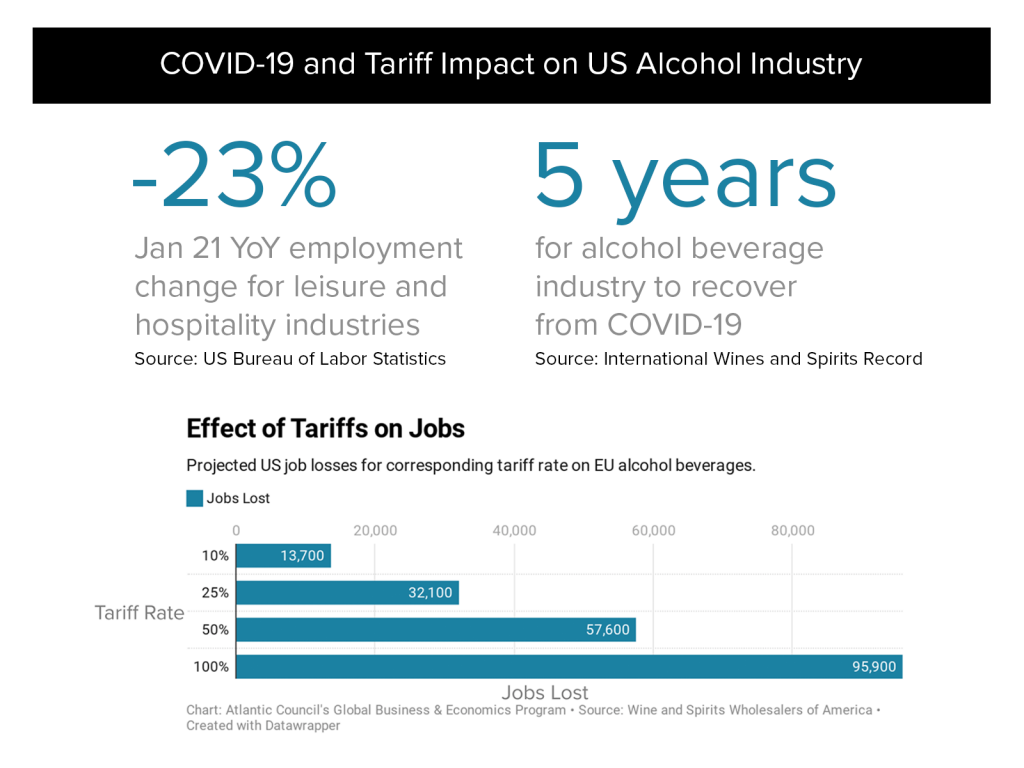

US and EU tariffs target Airbus and Boeing aircraft themselves but also agricultural goods such as French wine and American tobacco, with an outsized negative impact on small- and medium-sized enterprises (SMEs) on both sides of the Atlantic, compounded by the pandemic. The US hospitality sector illustrates the far-reaching negative effects of the tariffs for small companies that are facing an existential threat due to COVID-19. A wine industry analytics firm, cited by the New York Times, estimates that “for every dollar’s worth of [European] wine not imported because of the tariffs, consumers spent $4.52 less at American distributors, retailers and restaurants.” One might think that US wine producers benefit from higher prices on European competitors. To sell their product, however, American wineries rely on distributors’ profitability, which in turn depend on both domestic and foreign suppliers to survive. COVID-19 is putting immense pressure on the vulnerable US hospitality sector, despite the significant financial support it is receiving via the Paycheck Protection Program as well as state and local programs. Continued tariffs could further destabilize this industry that provides more than 10 percent of US private sector jobs. Broadly speaking, trade tariffs of this kind create a mutual dead-weight loss for both economies that outweigh any welfare benefits from protectionist measures.

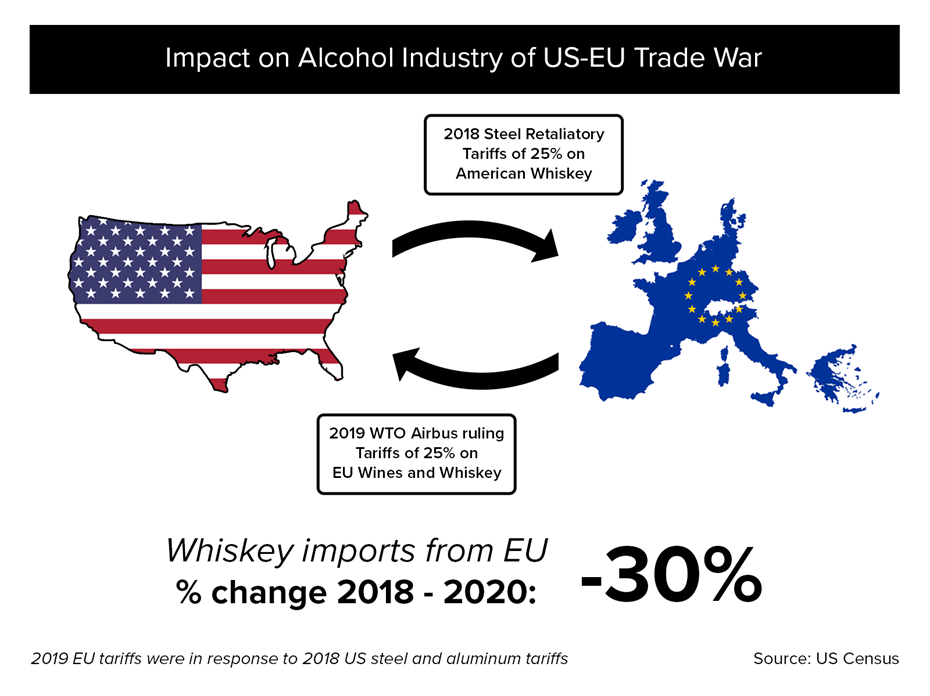

The Airbus–Boeing dispute is an important puzzle piece of the overall EU-US transatlantic trade spat. Trade remedies often target sectors unrelated to the dispute itself to undercut the other side’s perceived comparative advantage. In 2018, when the Trump administration first imposed tariffs on European exports of steel and aluminum, the EU retaliated with tariffs on more than $3 billion of US goods including bourbon whiskey. The US then used the WTO’s 2018 Airbus ruling to not only target aircraft but also continue the tariff tit-for-tat by imposing duties on EU agricultural goods including Scottish whiskey. The EU responded in kind following last year’s WTO Boeing decision by targeting a variety of US goods, such as tractors and tobacco, in addition to Boeing aircraft. Given the intertwined nature of these trade conflicts, a EU-US agreement on aircraft financing could have spill-over effects that also bring an end to the steel and aluminum tariffs.

Airbus and Boeing have already taken steps to move toward better compliance with WTO guidelines by working with their host governments in Germany, France, and Spain, as well as Washington State to remove favorable interest rates and tax breaks. Now it’s up to both companies, the EU Commission, and USTR to use this momentum to agree on a framework that governs civil aircraft financing going forward. Achieving a settlement would allow US and EU negotiators to turn their sights toward finding common ground on digital taxes, aligning transatlantic priorities on WTO reform, and jointly addressing China’s unfair trade practices. A new framework for aircraft financing could set a powerful example of how the US and EU can create cross-border regulatory standards to ensure rules-based, free trade across a strategically important industry.

Three years of transatlantic tariffs have demonstrated once more that trade protectionism creates more losers than winners. The USMCA members Canada and Mexico already have trade agreements with the EU. Over the long-term, the US needs one as well. Given the similar size and structure of both economies without clear lanes of comparative advantage, striking a comprehensive, TTIP like trade deal will not be easy. However, the United States needs a deal to protect against trade diversion where companies move to Canada or Mexico under USMCA to take advantage of these countries’ trade agreements with the EU.

EU Commission President von der Leyen is reportedly ready to suspend EU tariffs for six months in an effort to create a window of opportunity to address the most pressing transatlantic trade issues outlined above. The Biden Administration seeks trillions in federal assistance to assist Americans and their businesses, it should take the EU up on its bid. This will provide much needed support to SMEs in the US and jumpstart transatlantic trade talks.

"time" - Google News

February 13, 2021 at 04:20AM

https://ift.tt/3rPiPXU

Time for transatlantic trade to take off - Atlantic Council

"time" - Google News

https://ift.tt/3f5iuuC

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Time for transatlantic trade to take off - Atlantic Council"

Post a Comment