Many people investing for retirement know that it is risky, dangerous and stupid to try to time the market. To guess when stocks are high and sell them then guess again when they are at the bottom when they become bargains. Then repeat as necessary until your bank account is overflowing or all your hair has fallen out. Whichever comes first.

Opponents of the by-low-sell-high, repeat-as-necessary system include Warren Buffet, many Americans’ favorite billionaire and the late John Bogle, founder of Vanguard. Both said they couldn’t do it and they never met anyone who could. Still, lots of people — now with the ‘help’ of apps — think they can. So are you one of the lucky/gifted few who can read the markets when guys like Buffet and Bogle couldn’t. Take a test. In fact you’ve already taken it according to D.C. area financial planner Arthur Stein. He’s a former congressional economist who now advises clients — many of them current or former feds including some self-made millionaires — how to grow their TSP accounts and other investments.

Art Stein will be my guest today on our Your Turn radio show. It’s live at 10 a.m. EDT streaming online here or on 1500 AM in the D.C. area. He says the recent ups and downs of the stock market, after a record long 11 year bull market, have already tested TSP investors like you. Listen today if you can. Or catch the show, which will be archived on our homepage, later. And tell your friends. If you have questions for Art send them to me, before showtime, at mcausey@federalnewsnetwork.com. So how would you do in them Am I A Market Timer Test? This is what he wrote:

Are You a Patient Investor or Market Timer? You Just Took a Test! — By Arthur Stein, CFP®

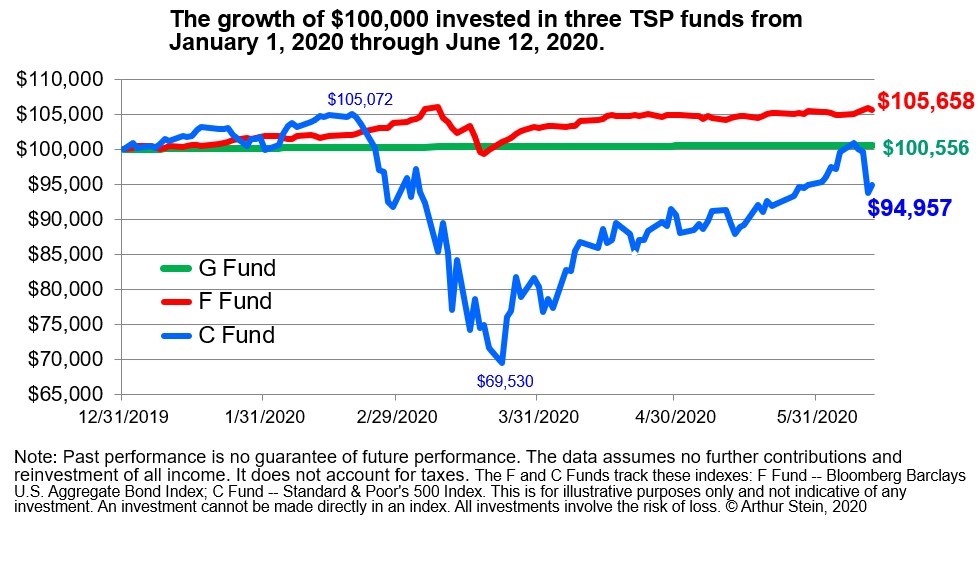

The stock markets tested us this year, as stocks sharply declined and then rebounded. The TSP C Fund (S&P 500 Stock Index) increased 5% by February 19, declined 34%, then increased 44% and then declined 5.9%. For all of 2020, the C Fund declined 5.9%. We went from a Bull Market to a Bear Market and back to a Bull Market in less than two months. Click here to learn about Bull and Bear Markets.

I call it a Patient Investor Test; during the declines, which investors held stock investments and which investors transferred out of stocks. Who was a “market timer” and who was a “patient investor?”Market timers try to sell in advance of a market decline and reinvest before stocks recover. That is extremely difficult for even the best professional investors. It requires two accurate forecasts: when will the market begin declining and when will it begin recovering. It also requires strong nerves to buy stocks when the market is crashing and other investors are selling.

Patient investors use a buy-and-hold strategy. They are content to stay invested in stocks during stock market declines. They see stocks as a good long-term investment and declines as temporary.

Historically, investors in well-diversified and well-managed stock portfolios did not have to buy and sell to profit. They only had to buy and hold for a sufficiently long period of time. Their patience was ultimately rewarded. Market timing wasn’t needed.

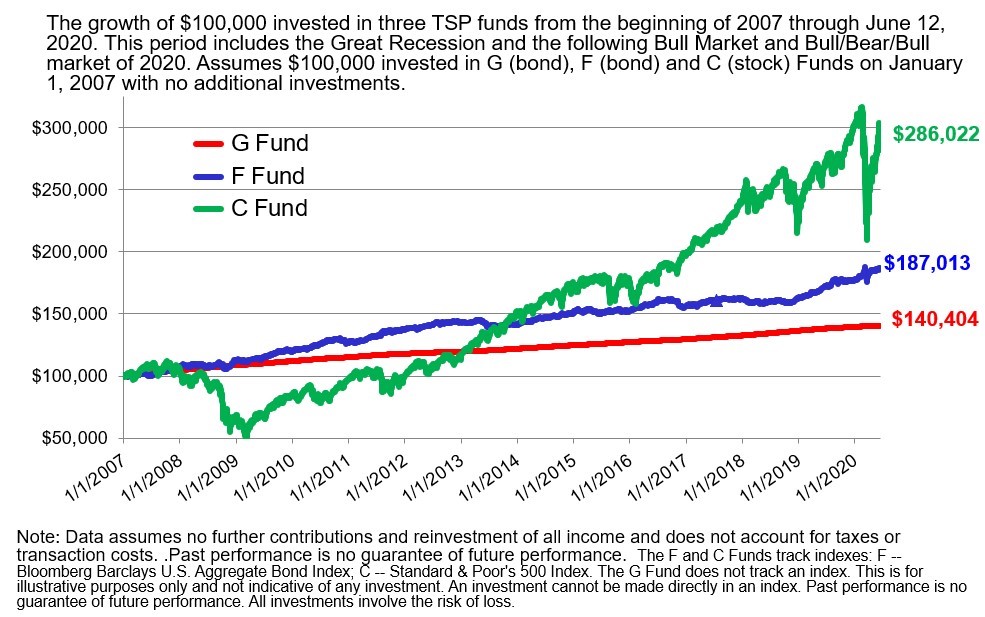

A tougher test occurred during the 2007-2009 “Great Recession.” The stock declines were worse than what occurred this year. But TSP participants who held onto the US stock funds were again rewarded for their patience. On June 12, 2020, a C Fund investment was 53% higher than F and 104% higher than the G Fund.

TSP participants who switched out of stock funds in February and March now face a dilemma; should they:

- Stay out of the stock funds, because world events seem unusually scary and the increase since the March low point appears to make stocks even less attractive, or

- Transfer back to stock investments now, hoping that the market decline was the worst that will happen for a long time. Unfortunately, that means paying more for the shares purchased now than for the shares sold in late February and March. Or, “selling low and buying high,” a strategy which always loses money.

That is a tough decision. A decision that can be avoided by staying invested in the stock funds during a decline.

Nearly Useless Factoid

By Alazar Moges

Father’s Day is coming up this weekend. George Washington, the first American president, is often billed as the “father of our country.” However, he never had any children of his own. It is believed that tuberculosis Washington contracted as a child may have rendered him sterile.

Source: University of Washington School of Medicine

"time" - Google News

June 17, 2020 at 06:59PM

https://ift.tt/2ALkCbB

Growing your TSP: Time to time the market? - Federal News Network

"time" - Google News

https://ift.tt/3f5iuuC

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Growing your TSP: Time to time the market? - Federal News Network"

Post a Comment